February Market Update

A Look at the Trends Shaping Our Region

As February arrives, the real estate markets in Dayton, Cincinnati, and Springfield continue to adjust to seasonal trends. January saw fluctuations in home values, total sales, and average days on market, providing valuable insights for buyers and sellers navigating the start of the year. Understanding these shifts can help guide informed decisions, whether you’re planning to buy, sell, or simply stay updated on market trends.

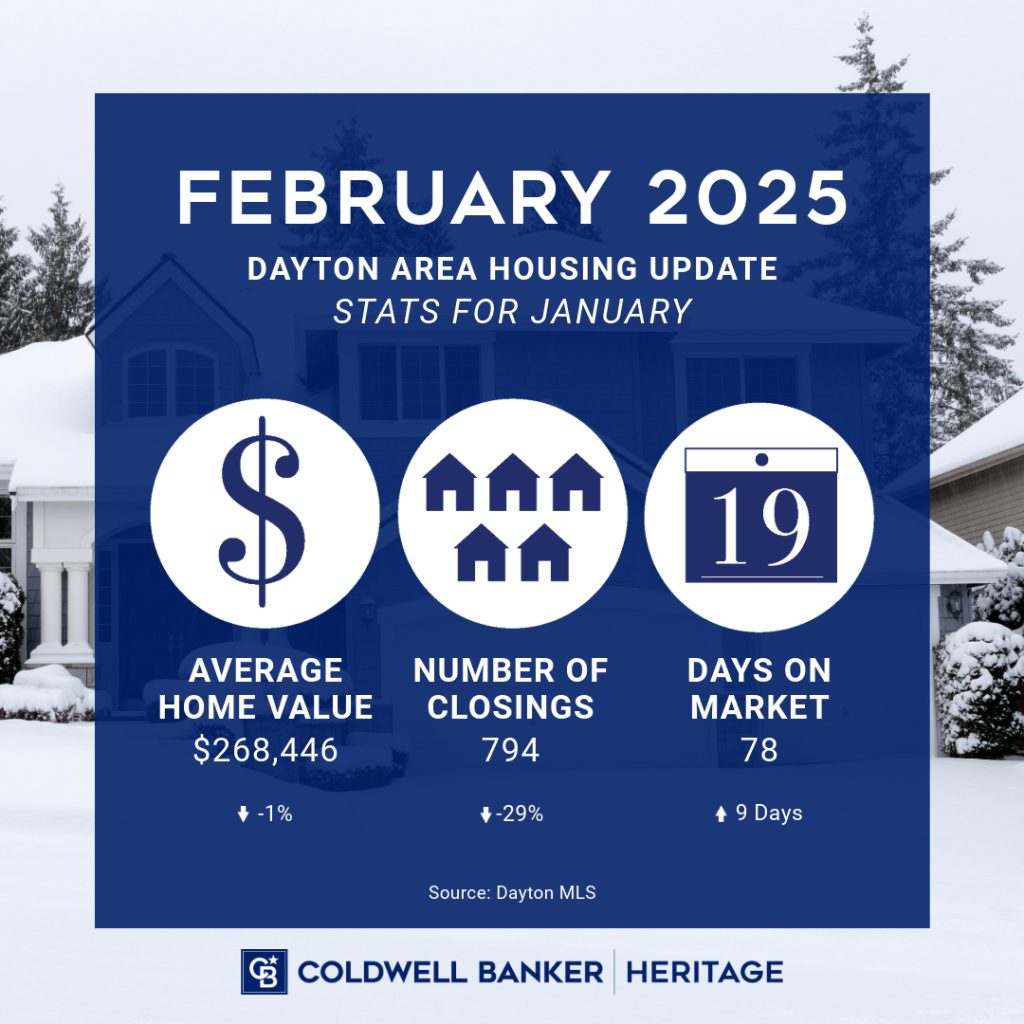

DAYTON

Dayton’s real estate market experienced a slight dip in both home values and total closings in January. A total of 794 sales were reported, marking a 29% decrease from December’s 1,120. The average sales price for January was $268,446, reflecting a 1% decrease from $271,231 last month. Properties in Dayton spent an average of 78 days on the market, an increase of 9 days compared to December’s 69 days.

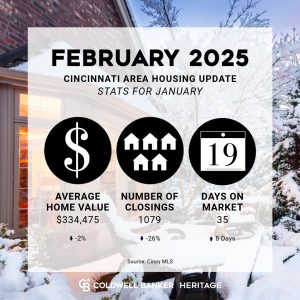

CINCINNATI

Cincinnati real estate market saw a slight drop in home values and total closings in January. The city recorded 1,079 sales, an 26% decrease from December’s 1,460. The average home price for January was $334,475, down 2% from $342,981 in December. Homes in Cincinnati remained on the market for an average of 35 days, an increase of 8 days compared to December’s 27 days.

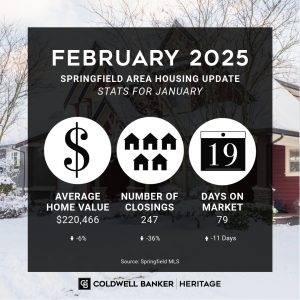

SPRINGFIELD

Springfield’s real estate market saw a decline in home values and sales in January. There were 247 sales, a 36% drop compared to 383 in December. The average home price for January was $220,466, representing a 6% decrease from $234,988 in December. However, the average days on market improved, decreasing from 90 days in December to 79 days in January.

As we move further into 2025, staying informed on market trends will be essential for making smart real estate decisions. Whether you’re looking to buy, sell, or simply track market changes, these insights can help you navigate the evolving landscape with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link